Contents

- Deducting Medical Expenses to Help Pay for Assisted Living

- Key Takeaways

- Understanding Tax Deductions for Assisted Living

- Tracking Eligible Medical Expenses

- Leveraging Professional Guidance

- Planning for Financial Relief

- Expert Care with Clear Pricing at Raya’s Paradise

- More Assisted Living Resources

- Does Assisted Living Provide Medical Care? Understanding Living Options and Care in Assisted Living Communities

- What Amenities Are Offered in Assisted Living? Services, Benefits, and Features for Residents

- What Is the Difference Between Assisted Living and Independent Living? Understanding the Options

- Assisted Living Move-In Checklist (Free PDF Download and Print)

- Assisted Living Facility Tour Checklist – Free PDF Download & Printable Guide

- Assisted Living vs. Senior Living - How Are They Different?

- What is Assisted Living and How Does it Work?

- What Are the Benefits of Assisted Living? 24-Hour Support, Socialization, Nutritious Meals and Peace of Mind

- Cost of Assisted Living in the Greater Los Angeles Area

- When’s the Best Age to Move to a Board and Care Community?

- Using Life Insurance to Pay for Assisted Living

- Is Dementia Genetic?

- How to Thank Assisted Living Staff

- How Often Should You Visit Your Parent in Assisted Living?

- Tips for Getting Cozy in Assisted Living

Deducting Medical Expenses to Help Pay for Assisted Living

Paying for assisted living is a significant financial commitment that many seniors and their families must navigate carefully. However, there’s good news: many of the expenses associated with assisted living are tax deductible.

These deductions can provide flexibility in your budget and help allocate funds more effectively. By understanding the criteria and keeping thorough records, you can maximize potential tax savings.

Key Takeaways

- Tax deductions for assisted living expenses can significantly reduce financial strain when certain conditions are met.

- Keep detailed records of all medical-related expenses, including less obvious items like transportation and assistive devices.

- Consult with a tax professional to ensure you’re maximizing deductions and complying with all requirements.

Assisted living costs can be tax deductible if the resident is considered “chronically ill,” expenses exceed 7.5% of adjusted gross income, and a licensed care plan is in place.

Understanding Tax Deductions for Assisted Living

To qualify for the greatest possible deductions, three key conditions must be met. First, the individual receiving care must be considered “chronically ill.”

According to the Health Insurance Portability and Accountability Act of 1996, this includes individuals who need assistance with activities of daily living such as bathing, dressing, and eating, or who require continuous supervision due to a cognitive impairment.

Second, the total amount of medical expenses paid must exceed 7.5% of the adjusted gross income of the person covering these costs.

Lastly, the resident’s care plan must be in accordance with the recommendations of a licensed health care provider, such as a doctor, nurse, or social worker. Assisted living facilities typically provide the necessary documentation to meet this requirement.

If these three criteria are satisfied, you may be able to deduct all assisted living costs, including room and board. Even if the resident does not qualify as chronically ill, portions of the fees related to medical care may still be deductible, provided total medical expenses exceed the 7.5% threshold.

Keep detailed records of all qualified expenses – from prescriptions and mobility aids to transportation and long-term care premiums – to ensure every eligible deduction is captured.

Tracking Eligible Medical Expenses

Meticulous record-keeping is essential to claim deductions for medical expenses. In addition to standard costs like appointments and prescriptions, there are often overlooked expenses that may qualify.

These include eyeglasses, dentures, canes, walkers, and transportation costs for medical appointments. Premiums for long-term care insurance can also be deductible, but only the portion of assisted living fees not covered by insurance is eligible.

Consult with your assisted living facility to determine which portions of fees are related to medical care. Maintaining organized records of all relevant receipts and documents will streamline the process of claiming deductions and ensure that nothing is overlooked.

An experienced CPA or tax advisor can uncover overlooked credits, clarify IRS medical deduction rules, and help families optimize assisted living expenses for maximum benefit.

Leveraging Professional Guidance

For specific guidance, consult with an accountant or tax professional. They can help identify additional tax credits you may qualify for, provide advice on itemizing deductions effectively, and guide you through the nuances of state-specific tax rules. Accountants can also help navigate deductions for family caregivers who incur out-of-pocket expenses related to their loved one’s care.

Combining smart record-keeping with professional advice helps families reduce costs, plan budgets effectively, and secure compassionate senior care without financial strain.

Planning for Financial Relief

Assisted living expenses often feel daunting, but taking advantage of available tax deductions can ease the financial burden.

By meeting eligibility requirements, tracking all eligible expenses, and seeking professional advice, families can create a more manageable financial strategy while ensuring their loved one receives the care they need.

Expert Care with Clear Pricing at Raya’s Paradise

At Raya’s Paradise, we understand the financial challenges of senior care. Our communities in Los Angeles and Orange County provide exceptional assisted living services with straightforward pricing to help families plan effectively. Contact us today to learn more about how we can support your loved one’s journey with compassionate, personalized care.

Our Senior Assisted Living with Memory Care Community in Orange County, CA

Our Assisted Living Residences for Seniors in Los Angeles

More Assisted Living Resources

Does Assisted Living Provide Medical Care? Understanding Living Options and Care in Assisted Living Communities

Assisted Living Resources, Family Resources

What Amenities Are Offered in Assisted Living? Services, Benefits, and Features for Residents

Assisted Living Resources

What Is the Difference Between Assisted Living and Independent Living? Understanding the Options

Assisted Living Resources, Senior Care Resources

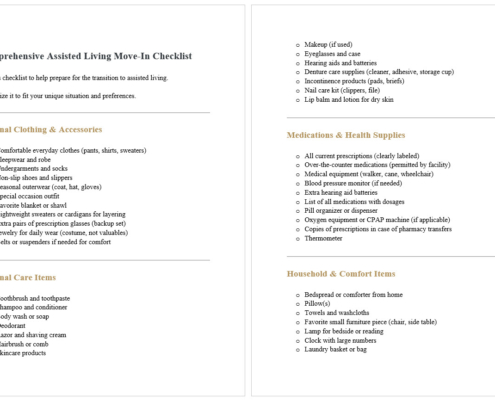

Assisted Living Move-In Checklist (Free PDF Download and Print)

Assisted Living Resources

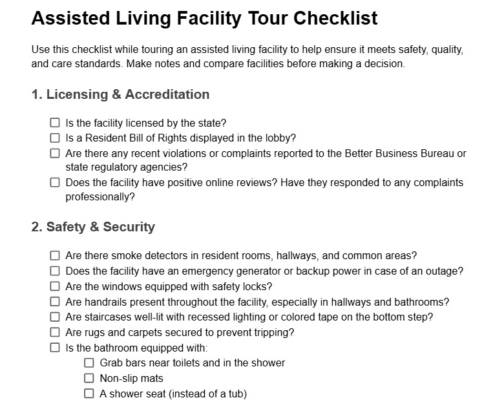

Assisted Living Facility Tour Checklist – Free PDF Download & Printable Guide

Assisted Living Resources, Family Resources, Senior Care Resources

Assisted Living vs. Senior Living - How Are They Different?

Assisted Living Resources, Senior Care Resources

What is Assisted Living and How Does it Work?

Assisted Living Resources

What Are the Benefits of Assisted Living? 24-Hour Support, Socialization, Nutritious Meals and Peace of Mind

Assisted Living Resources

Cost of Assisted Living in the Greater Los Angeles Area

Assisted Living Resources

When’s the Best Age to Move to a Board and Care Community?

Assisted Living Resources

Using Life Insurance to Pay for Assisted Living

Assisted Living Resources, Family Resources

Is Dementia Genetic?

Assisted Living Resources, Memory Care Resources

How to Thank Assisted Living Staff

Assisted Living Resources, Family Resources

How Often Should You Visit Your Parent in Assisted Living?

Assisted Living Resources, Family Resources